by Vic Patel

There are over a dozen main Clear Vitality ETFs obtainable to buyers. However which one is the very best one to place your hard-earned cash into? Greatest can imply various things to totally different folks primarily based on their funding preferences and threat profile.

On this article, I’ll present a extra empirical primarily based purpose behind why I consider that PZD is essentially the most enticing Clear Vitality ETF in the mean time. I’ve primarily based on my evaluation of 4 main elements: liquidity, diversification, current worth motion, and final however not least expense ratio.

Liquidity needs to be a significant consideration within the choice of any monetary asset. The shortage of ample liquidity can result in wider bid ask pricing, and problem in environment friendly commerce execution

High 5 Most Liquid Clear Vitality ETFs (primarily based on 3 month Avg. Every day Quantity)

TAN – 135,000

PZD – 7,512

ICLN – 79,979

PBW – 13,373

QCLN – 15,318

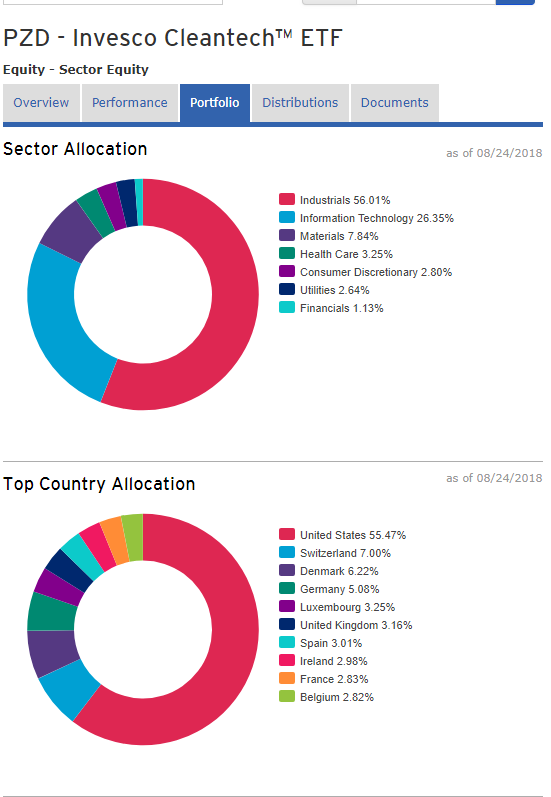

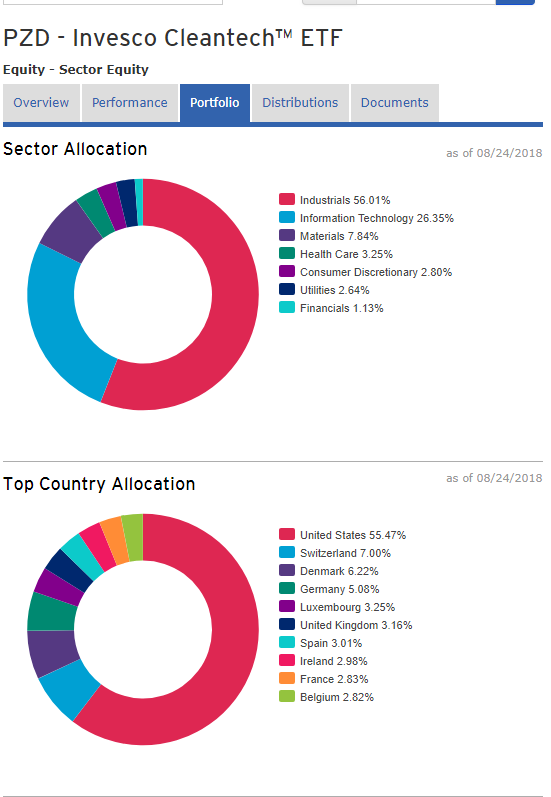

Since I all the time need to cut back threat by way of diversification. ETFs with a bigger numbers of holding and a lesser focus within the high 10 are essentially the most diversified. So, subsequent, I analyzed the variety of holdings inside every ETF and the focus of its’ high 10 holdings. You’ll discover the outcomes of that beneath.

Variety of holdings

PZD 51 (31% focus in high 10 holdings)

PBW 40 (36% focus in high 10 holdings)

ICLN 31 (55% focus in high 10 holdings)

QCLN 39 (57% focus in high 10 holdings)

Clear Winner: PZD

From right here, I took a take a look at the worth chart of every ETF on our checklist. What I primarily wished to see for every was the place the present worth was buying and selling in relation its 200 interval moving average. The 200 interval shifting common is a broadly watched metric by technical merchants, particularly retail pattern merchants. When worth is above the 200 interval shifting common, this group tends to remain on the lengthy facet of the market, and when worth is beneath the 200 interval shifting common they decide to remain flat or on the quick facet of the market.

This could typically bolster costs or place further strain on the worth of the ETF relying on the the place worth is buying and selling in relation to this 200 MA. As such, we need to align our place with that order move at any time when attainable. So, when costs are buying and selling above it, it’s thought-about a bullish signal. And opposite to that, when costs are buying and selling beneath the 200 interval shifting common, it’s thought-about a bearish signal. Primarily, I wished to filter out any of those ETFs that had been buying and selling beneath their 200 interval shifting common.

PZD, PBW, and QCLN made the reduce, as every was buying and selling above its 200 interval shifting common. ICLN and TAN nonetheless wanted to be filtered out because of their buying and selling beneath its 200 interval shifting common.

So now we’re down to a few. The ultimate piece of study concerned evaluating every of the remaining three ETFs to see how their Expense Ratios measured up. The outcomes are beneath:

Expense Ratio Comparability

PZD .68

PBW .70

QCLN .60

The expense ratios appear to be comparatively related for all three, so there is no such thing as a clear winner or loser there.

Conclusion

So right here what PZD (Invesco Cleantech ETF) has going for it and the rationale I consider it’s the greatest Clear Vitality ETF to purchase:

This market evaluation was performed by Vic Patel, He’s an skilled dealer with over 20+ 12 months within the markets. He additionally runs a preferred buying and selling weblog at Foreign exchange Coaching Group.

**Information Supply – ETFDB.com

There are over a dozen main Clear Vitality ETFs obtainable to buyers. However which one is the very best one to place your hard-earned cash into? Greatest can imply various things to totally different folks primarily based on their funding preferences and threat profile.

On this article, I’ll present a extra empirical primarily based purpose behind why I consider that PZD is essentially the most enticing Clear Vitality ETF in the mean time. I’ve primarily based on my evaluation of 4 main elements: liquidity, diversification, current worth motion, and final however not least expense ratio.

Liquidity needs to be a significant consideration within the choice of any monetary asset. The shortage of ample liquidity can result in wider bid ask pricing, and problem in environment friendly commerce execution

High 5 Most Liquid Clear Vitality ETFs (primarily based on 3 month Avg. Every day Quantity)

TAN – 135,000

PZD – 7,512

ICLN – 79,979

PBW – 13,373

QCLN – 15,318

Since I all the time need to cut back threat by way of diversification. ETFs with a bigger numbers of holding and a lesser focus within the high 10 are essentially the most diversified. So, subsequent, I analyzed the variety of holdings inside every ETF and the focus of its’ high 10 holdings. You’ll discover the outcomes of that beneath.

Variety of holdings

PZD 51 (31% focus in high 10 holdings)

PBW 40 (36% focus in high 10 holdings)

ICLN 31 (55% focus in high 10 holdings)

QCLN 39 (57% focus in high 10 holdings)

Clear Winner: PZD

From right here, I took a take a look at the worth chart of every ETF on our checklist. What I primarily wished to see for every was the place the present worth was buying and selling in relation its 200 interval moving average. The 200 interval shifting common is a broadly watched metric by technical merchants, particularly retail pattern merchants. When worth is above the 200 interval shifting common, this group tends to remain on the lengthy facet of the market, and when worth is beneath the 200 interval shifting common they decide to remain flat or on the quick facet of the market.

This could typically bolster costs or place further strain on the worth of the ETF relying on the the place worth is buying and selling in relation to this 200 MA. As such, we need to align our place with that order move at any time when attainable. So, when costs are buying and selling above it, it’s thought-about a bullish signal. And opposite to that, when costs are buying and selling beneath the 200 interval shifting common, it’s thought-about a bearish signal. Primarily, I wished to filter out any of those ETFs that had been buying and selling beneath their 200 interval shifting common.

PZD, PBW, and QCLN made the reduce, as every was buying and selling above its 200 interval shifting common. ICLN and TAN nonetheless wanted to be filtered out because of their buying and selling beneath its 200 interval shifting common.

So now we’re down to a few. The ultimate piece of study concerned evaluating every of the remaining three ETFs to see how their Expense Ratios measured up. The outcomes are beneath:

Expense Ratio Comparability

PZD .68

PBW .70

QCLN .60

The expense ratios appear to be comparatively related for all three, so there is no such thing as a clear winner or loser there.

Conclusion

So right here what PZD (Invesco Cleantech ETF) has going for it and the rationale I consider it’s the greatest Clear Vitality ETF to purchase:

- PZD is a comparatively liquid ETF.

- PZD has the most important variety of holdings and the least focus within the high 10% of its holdings.

- PZD is buying and selling above the 200 interval shifting common.

- PZD has an affordable expense ratio primarily based on its peer class.

This market evaluation was performed by Vic Patel, He’s an skilled dealer with over 20+ 12 months within the markets. He additionally runs a preferred buying and selling weblog at Foreign exchange Coaching Group.

**Information Supply – ETFDB.com