There are a lot of issues that frustrate me about being an expat in Australia: the shortage of Amazon Prime, the truth that my glorious US credit score rating means diddly squat and by some means I don’t qualify for any bank cards or financing right here, not having the ability to log into a number of of my US accounts on-line as a result of they require telephone verification with a US telephone quantity, how unbelievably tough it’s to vote in US elections, and continually having to switch cash between my US and Aussie financial institution accounts – simply to call a couple of.

However the largest ache within the arse about being an American expat residing in Australia? Having to file tax returns TWICE A YEAR. As if as soon as wasn’t sufficient torture!

Yep, People are obligated to file a US tax return yearly, even after they spend zero time within the US and do zero work for US purchasers, even when they completely reside abroad… till and except they resolve to surrender their US citizenship.

Mercifully, the US has tax treaties in place with sure nations (certainly one of which is Australia) which stop expats from getting double taxed. So whereas I need to file a tax return for each the US and Australia, I solely really pay tax to 1 nation. Thank GOD for that!

Life as an expat is all enjoyable and sunsets till it’s time for the subsequent tax return.

I at all times accomplished my very own tax returns after I lived within the US and, whereas it normally took me the higher a part of a day (and a bottle of wine, let’s be trustworthy) to navigate TurboTax, it at all times felt manageable to me.

However now that I’ve two nations to report back to, and an more and more outside-the-box work state of affairs to cope with, taxes have grow to be infinitely extra aggravating for me. At this level, I’m keen to pay another person for the peace of thoughts of getting my tax returns accomplished appropriately.

In Australia, there are shockingly few accountants focusing on each US and Australian taxes, which might have been supreme – however alas. There additionally aren’t that many accountants Down Underneath which are conversant in the US tax system, and people who do cost a premium for his or her providers. I simply wasn’t wiling to go from spending $0 to spending $1000 on a tax return, in order that possibility was out.

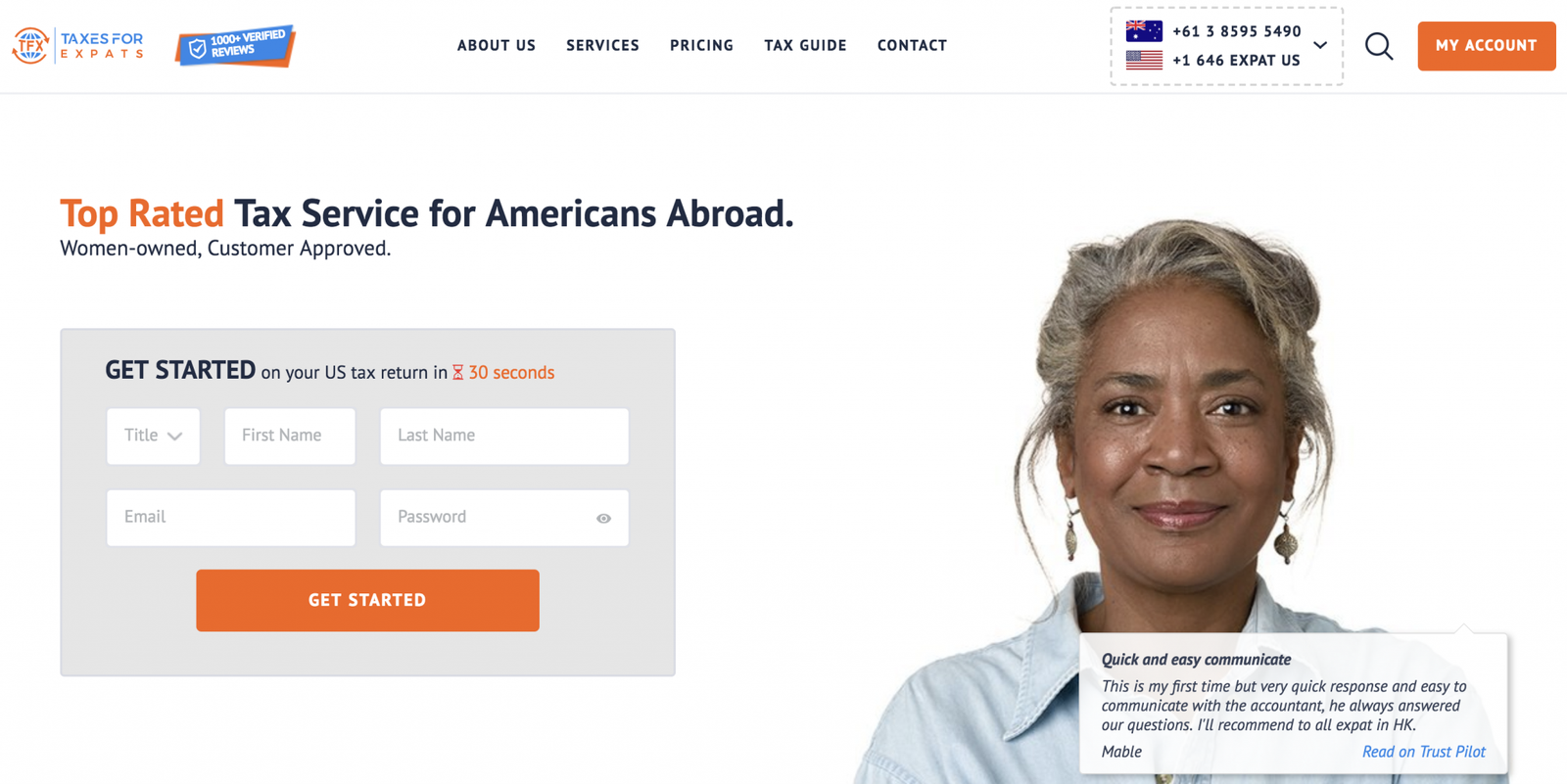

That’s about when I discovered Taxes For Expats on certainly one of my frantic Google searches. This firm is US-based, however works solely with People residing overseas – at an inexpensive price, besides!

Shortly after wrapping up my US tax return for this 12 months, somebody from the corporate reached out to me and requested if I’d be desirous about writing an article for my weblog in regards to the Taxes For Expats course of and advantages. I needed to say this as a result of I need y’all to know that 1). I sought out and paid for his or her expat tax providers first; 2). Once they reached out to me, they have been unaware that I used to be already a shopper of theirs.

All that to say, that is very a lot a real account of my expertise working with Taxes For Expats. I employed them to file my US tax return by myself accord, and never as a result of they needed to work with me as a blogger. I’m glad to jot down about services and products I already use and love, and that is no exception.

Alright, now let’s get into it! Right here’s what it was like working with Taxes For Expats on my US tax return whereas residing in Australia – and the way they saved me many a greenback and grey hair.

First, let me simply say that the very best factor about Taxes For Expats is how clear and straightforward their course of is.

They’ve a pricing page that particulars all of their charges: it’s $350 for a fundamental tax return, + $100 when you have any self employment revenue, and + $75 for FBAR (which it’s essential file when you had no less than US$10,000 complete throughout all of your non-US financial institution accounts at any level throughout the tax 12 months). So immediately, I knew I’d be paying $450 for my US expat taxes earlier than I even contacted them. (FYI I keep away from FBAR by continually shifting cash from my Aussie account to my US account utilizing CurrencyFair, as my scholar mortgage funds and bank card payments all come out of my US account).

Anyway, I actually respect when companies are clear with their pricing. I get that lots of them don’t wish to record their costs on their web site so that folks must contact them and ask inquire their providers, however I believe that’s sneaky and fairly actually, I normally exit a web site if I can’t discover the costs straight away.

So as soon as I found out that I might afford their expat tax providers, I learn up on how their process works.

Fortunately every little thing is finished on-line by means of their web site and follows a set process, which is tremendous handy as a result of 1). Coordinating telephone calls and going back-and-forth with expats situated all around the world may be difficult and never very time environment friendly, and a couple of). No want for e-mail chains! I’m into it.

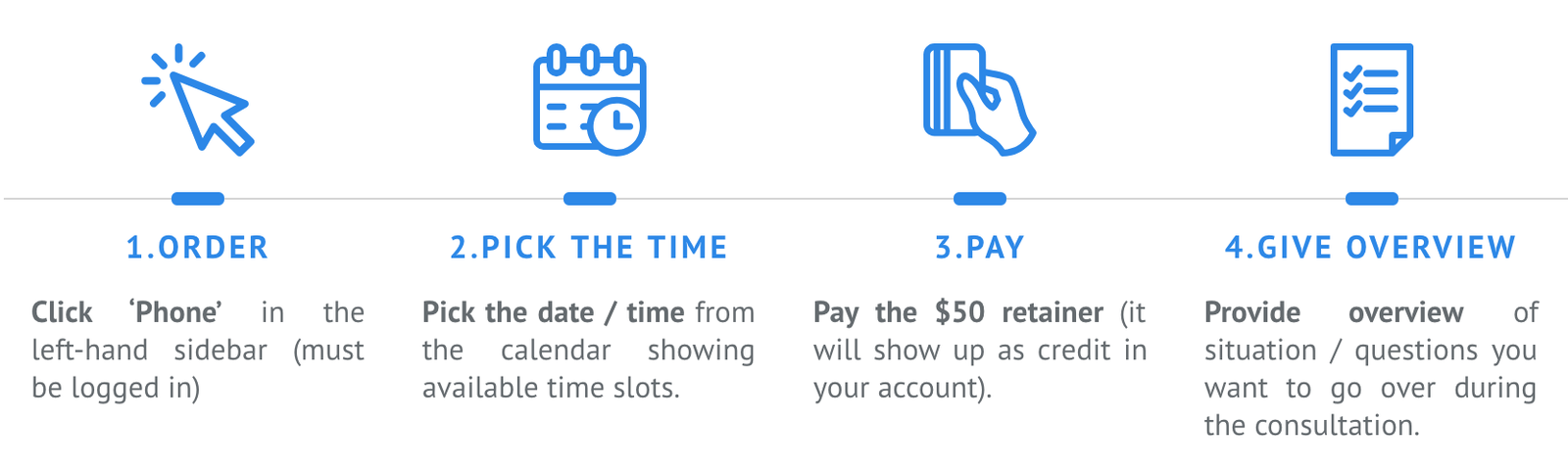

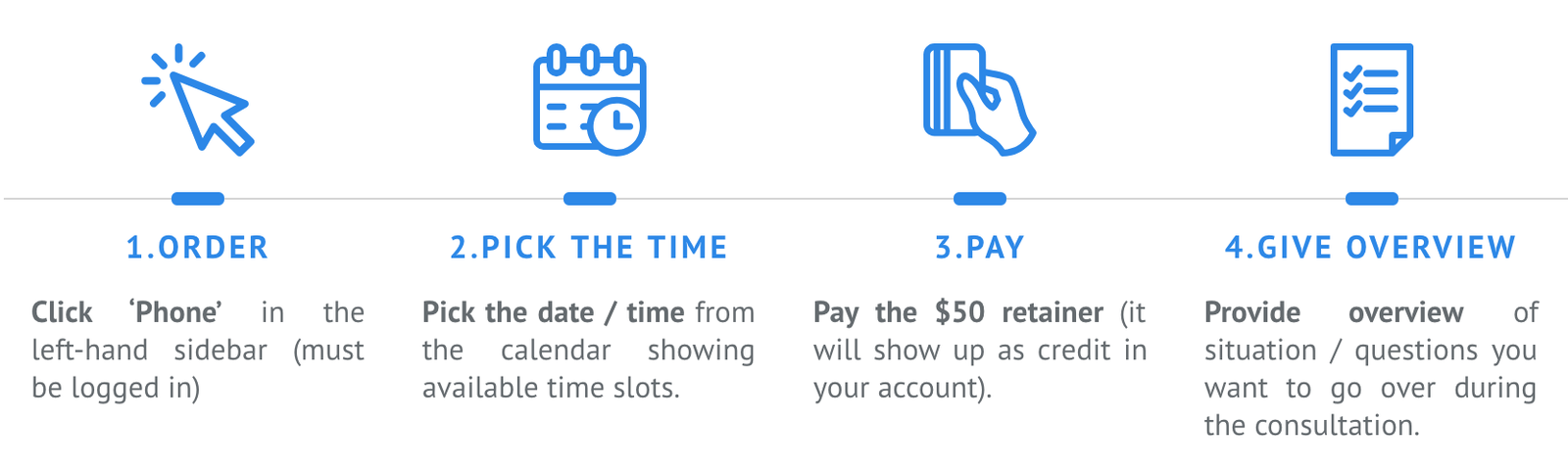

Nonetheless, I used to be really eager to reap the benefits of their optionally available 30 minute phone consultation – you pay $50 for it, however this will get credited towards the value of the tax return which I believe may be very honest. To get essentially the most out of it, I’d advocate making ready an inventory of questions beforehand – I consider you possibly can embrace these as notes if you e book the session, which helps the accountant put together some solutions prematurely of your name. I had a bunch of questions I needed readability on along with the overarching query of WHICH COUNTRY DO I PAY TAXES TO, reminiscent of whether or not I nonetheless owed US self employment tax, whether or not I wanted to file a US state tax return, and if it might be useful to begin a enterprise in Australia.

The individual I spoke to for the session was not the identical one that accomplished my tax return, however he was very useful and identified that I’d most likely needlessly been paying US self employment tax the previous few years. That ALONE saved me 1000’s of {dollars}. Observe that Taxes For Expats can even file amended tax returns for you when you assume you’ll have messed them up in earlier years – that is particularly value doing when you’ll find yourself getting a tax refund that exceeds the price of submitting the amended return.

After the telephone session, I felt good about hiring Taxes For Expats to finish my US tax return and determined to proceed on with the subsequent step within the course of: filling out the questionnaire.

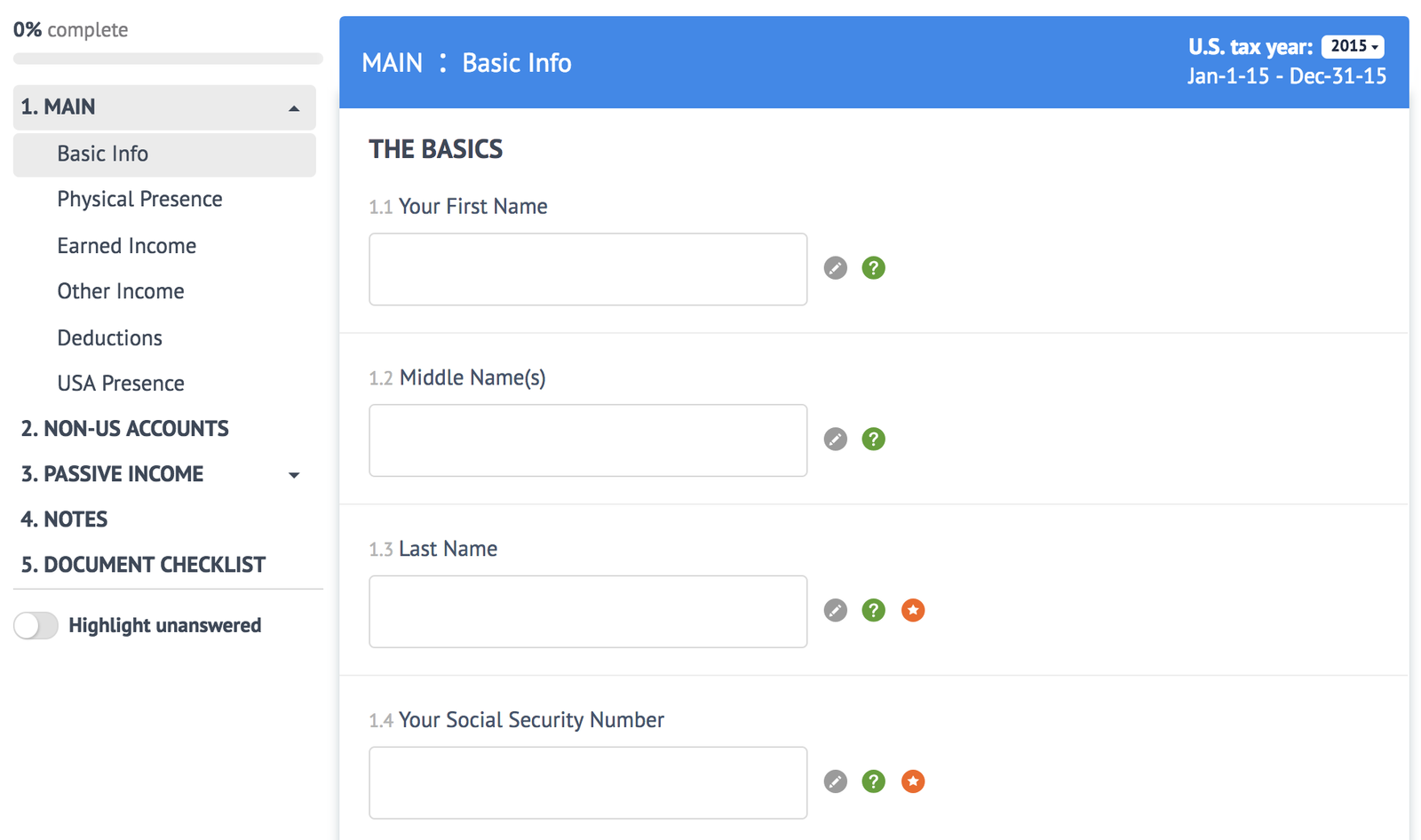

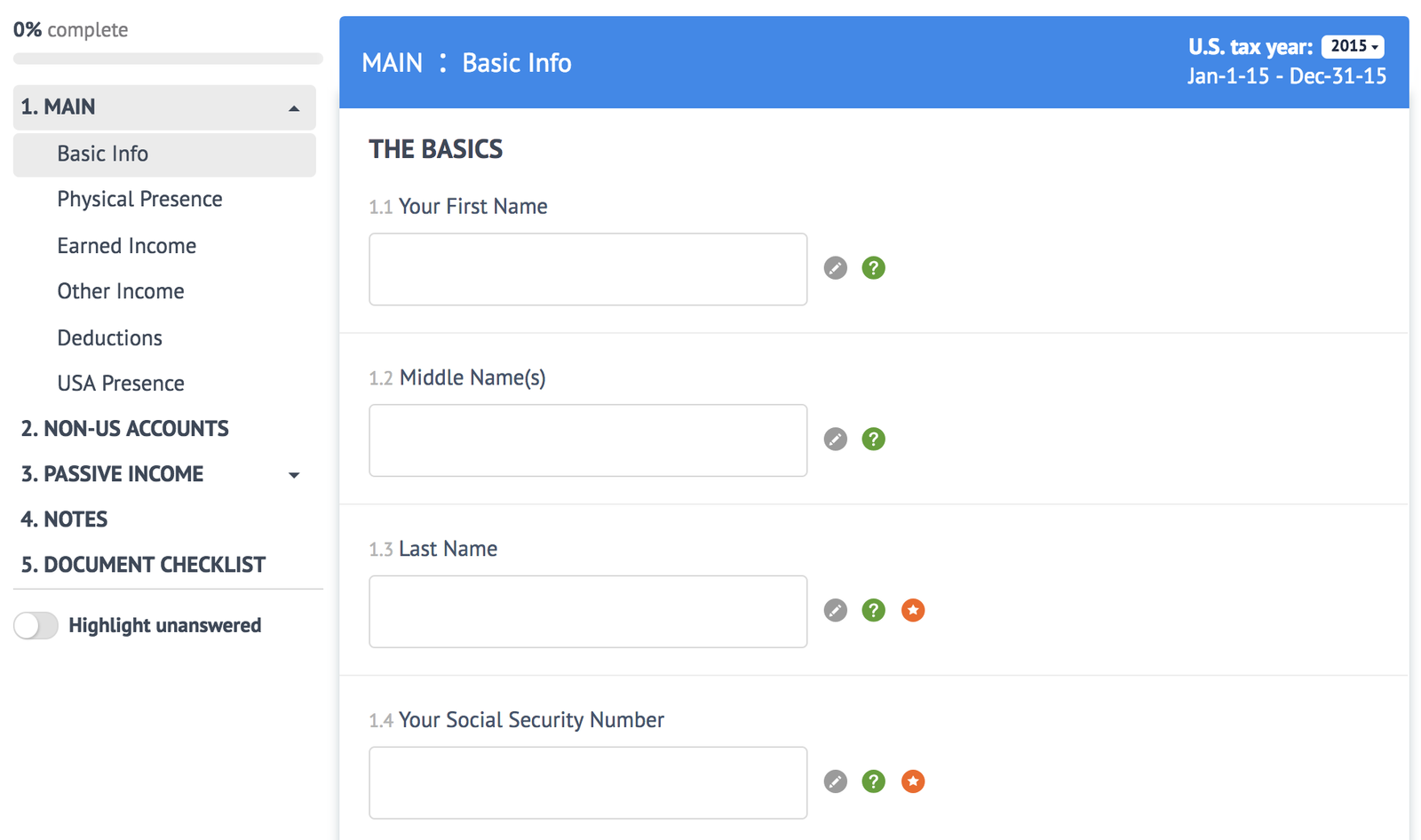

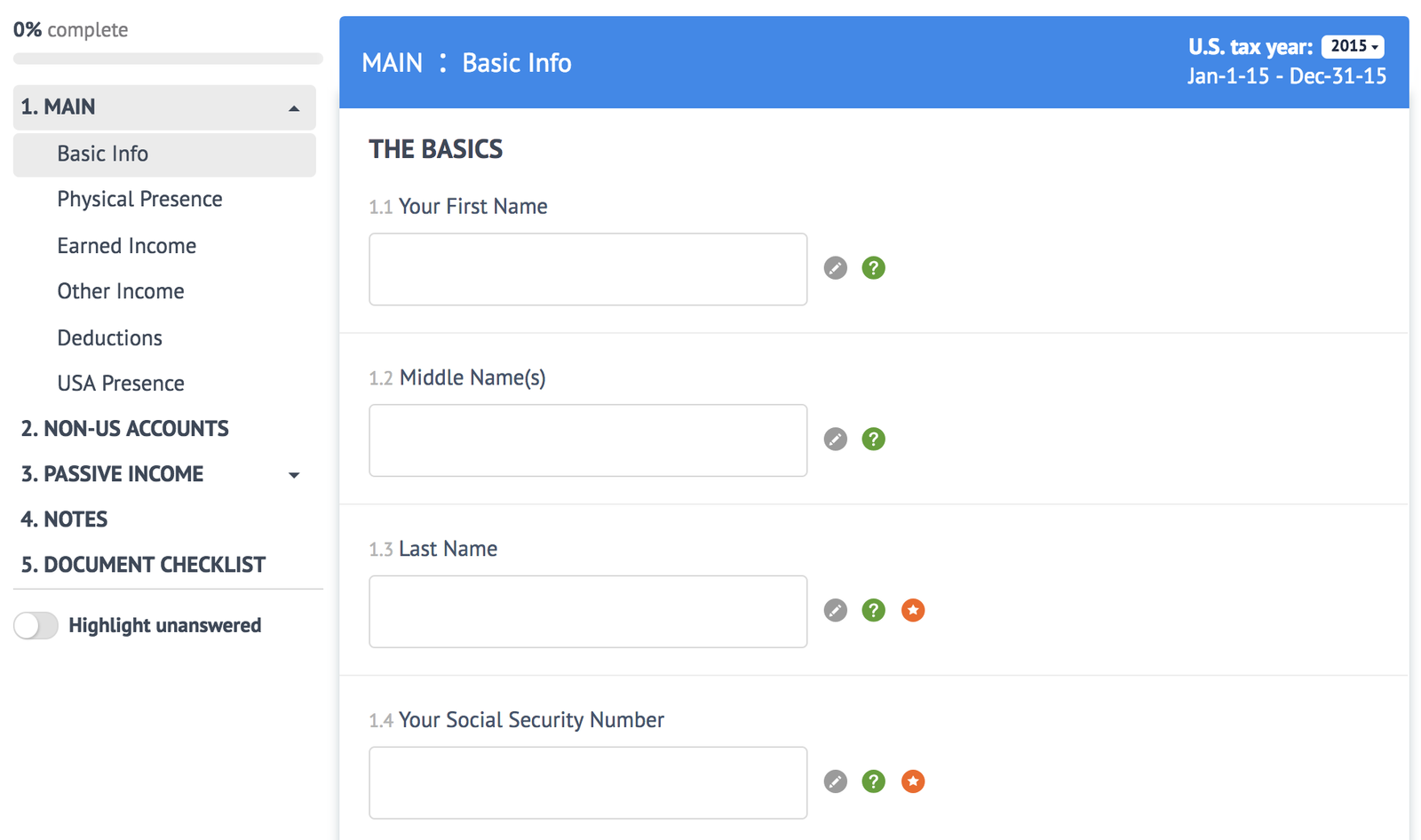

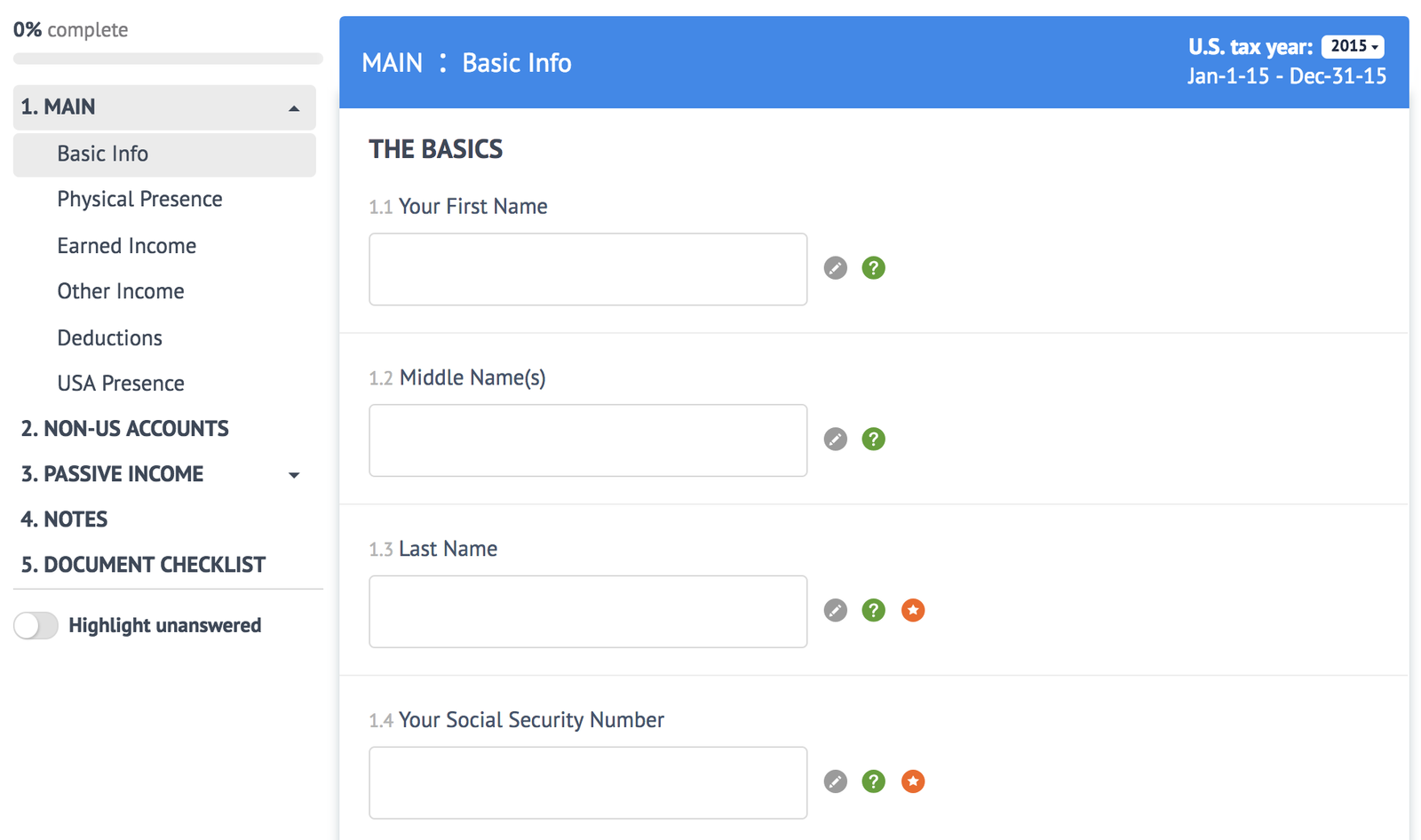

It’s prolonged, however it sort of must be since they want all of your particulars with the intention to fill out your tax return, to not point out decide how greatest to reduce your taxes owed. It’s value it to take the time to offer them with as many particulars and related paperwork as you possibly can.

You’re capable of add paperwork and add notes to your questionnaire, each of which I extremely advocate doing. Within the notes, I wrote a couple of sentences explaining my residing state of affairs (from the US, completely residing in Australia) and work state of affairs (a shit present… simply kidding! Extra like, a number of revenue streams and unable to slot in any present field). I uploaded my tax returns from final 12 months, my revenue and expense spreadsheets, and any tax kinds I obtained associated to my financial institution accounts and scholar loans.

Not too lengthy after, my assigned accountant despatched me an digital engagement letter – principally a contract for me to learn and signal, granting her permission to proceed with my tax return. The letter contains the whole quantity you’ll be charged for his or her providers, however you gained’t must pay till after they end their work. It took about two weeks for my tax return to be accomplished after signing the engagement letter. I wasn’t in a rush, as expats get an computerized two-month extension for submitting.

Now, everybody’s tax state of affairs is totally different, so this won’t be what your US expat taxes appear to be… however for me, Taxes For Expats helped me decide the next:

In the event you’re a US citizen residing and dealing overseas, I can undoubtedly advocate Taxes For Expats for finding out your US expat taxes. They’re tremendous straightforward to work with regardless of the place you’re on the earth, very clear about what they do and the way a lot they cost for it, and would possibly even be capable to prevent some cash in your tax returns.

Going ahead, my plan for tackling my twice-annual tax returns as an American expat completely residing in Australia is to work with Taxes For Expats for my US tax return, and an area accountant in Sydney for my Australian tax return.

If you wish to give Taxes For Expats a attempt, sign up using this link and also you’ll get $25 off your first tax return with them!

However the largest ache within the arse about being an American expat residing in Australia? Having to file tax returns TWICE A YEAR. As if as soon as wasn’t sufficient torture!

Yep, People are obligated to file a US tax return yearly, even after they spend zero time within the US and do zero work for US purchasers, even when they completely reside abroad… till and except they resolve to surrender their US citizenship.

Mercifully, the US has tax treaties in place with sure nations (certainly one of which is Australia) which stop expats from getting double taxed. So whereas I need to file a tax return for each the US and Australia, I solely really pay tax to 1 nation. Thank GOD for that!

Life as an expat is all enjoyable and sunsets till it’s time for the subsequent tax return.

I at all times accomplished my very own tax returns after I lived within the US and, whereas it normally took me the higher a part of a day (and a bottle of wine, let’s be trustworthy) to navigate TurboTax, it at all times felt manageable to me.

However now that I’ve two nations to report back to, and an more and more outside-the-box work state of affairs to cope with, taxes have grow to be infinitely extra aggravating for me. At this level, I’m keen to pay another person for the peace of thoughts of getting my tax returns accomplished appropriately.

In Australia, there are shockingly few accountants focusing on each US and Australian taxes, which might have been supreme – however alas. There additionally aren’t that many accountants Down Underneath which are conversant in the US tax system, and people who do cost a premium for his or her providers. I simply wasn’t wiling to go from spending $0 to spending $1000 on a tax return, in order that possibility was out.

That’s about when I discovered Taxes For Expats on certainly one of my frantic Google searches. This firm is US-based, however works solely with People residing overseas – at an inexpensive price, besides!

Shortly after wrapping up my US tax return for this 12 months, somebody from the corporate reached out to me and requested if I’d be desirous about writing an article for my weblog in regards to the Taxes For Expats course of and advantages. I needed to say this as a result of I need y’all to know that 1). I sought out and paid for his or her expat tax providers first; 2). Once they reached out to me, they have been unaware that I used to be already a shopper of theirs.

All that to say, that is very a lot a real account of my expertise working with Taxes For Expats. I employed them to file my US tax return by myself accord, and never as a result of they needed to work with me as a blogger. I’m glad to jot down about services and products I already use and love, and that is no exception.

Alright, now let’s get into it! Right here’s what it was like working with Taxes For Expats on my US tax return whereas residing in Australia – and the way they saved me many a greenback and grey hair.

Expat Tax Providers by Taxes For Expats

First, let me simply say that the very best factor about Taxes For Expats is how clear and straightforward their course of is.

They’ve a pricing page that particulars all of their charges: it’s $350 for a fundamental tax return, + $100 when you have any self employment revenue, and + $75 for FBAR (which it’s essential file when you had no less than US$10,000 complete throughout all of your non-US financial institution accounts at any level throughout the tax 12 months). So immediately, I knew I’d be paying $450 for my US expat taxes earlier than I even contacted them. (FYI I keep away from FBAR by continually shifting cash from my Aussie account to my US account utilizing CurrencyFair, as my scholar mortgage funds and bank card payments all come out of my US account).

Anyway, I actually respect when companies are clear with their pricing. I get that lots of them don’t wish to record their costs on their web site so that folks must contact them and ask inquire their providers, however I believe that’s sneaky and fairly actually, I normally exit a web site if I can’t discover the costs straight away.

So as soon as I found out that I might afford their expat tax providers, I learn up on how their process works.

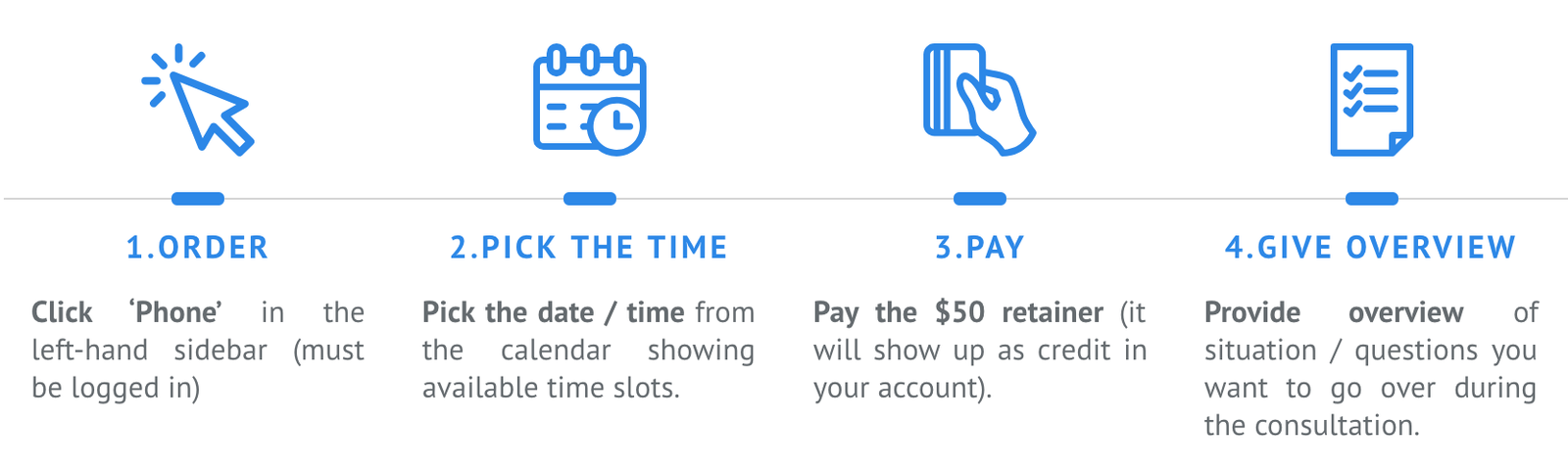

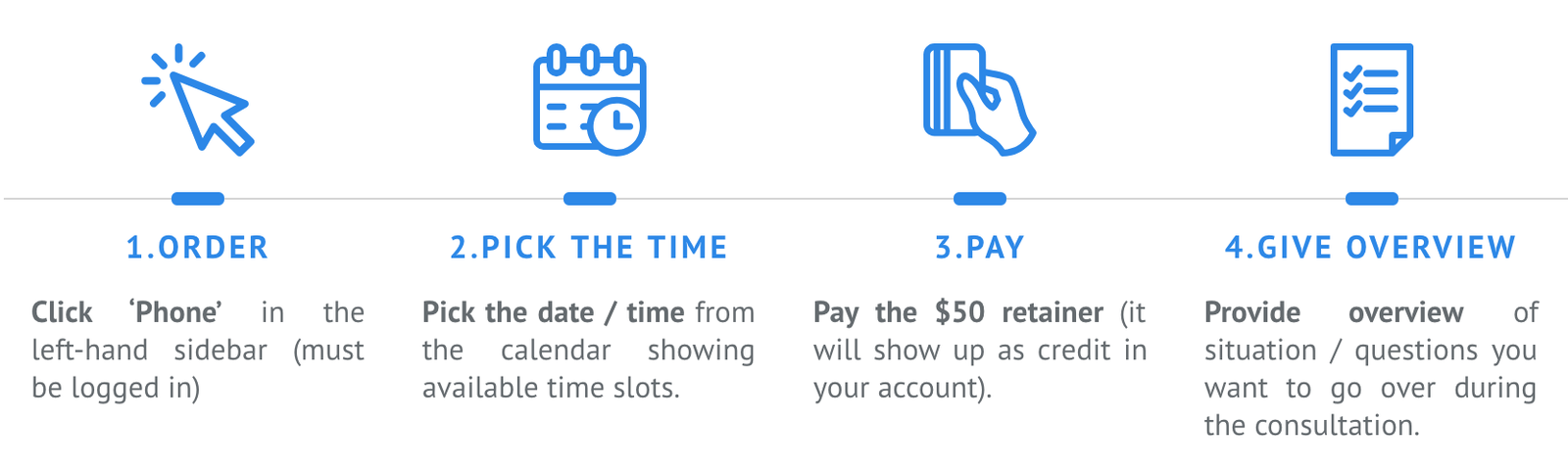

Fortunately every little thing is finished on-line by means of their web site and follows a set process, which is tremendous handy as a result of 1). Coordinating telephone calls and going back-and-forth with expats situated all around the world may be difficult and never very time environment friendly, and a couple of). No want for e-mail chains! I’m into it.

Nonetheless, I used to be really eager to reap the benefits of their optionally available 30 minute phone consultation – you pay $50 for it, however this will get credited towards the value of the tax return which I believe may be very honest. To get essentially the most out of it, I’d advocate making ready an inventory of questions beforehand – I consider you possibly can embrace these as notes if you e book the session, which helps the accountant put together some solutions prematurely of your name. I had a bunch of questions I needed readability on along with the overarching query of WHICH COUNTRY DO I PAY TAXES TO, reminiscent of whether or not I nonetheless owed US self employment tax, whether or not I wanted to file a US state tax return, and if it might be useful to begin a enterprise in Australia.

The individual I spoke to for the session was not the identical one that accomplished my tax return, however he was very useful and identified that I’d most likely needlessly been paying US self employment tax the previous few years. That ALONE saved me 1000’s of {dollars}. Observe that Taxes For Expats can even file amended tax returns for you when you assume you’ll have messed them up in earlier years – that is particularly value doing when you’ll find yourself getting a tax refund that exceeds the price of submitting the amended return.

After the telephone session, I felt good about hiring Taxes For Expats to finish my US tax return and determined to proceed on with the subsequent step within the course of: filling out the questionnaire.

It’s prolonged, however it sort of must be since they want all of your particulars with the intention to fill out your tax return, to not point out decide how greatest to reduce your taxes owed. It’s value it to take the time to offer them with as many particulars and related paperwork as you possibly can.

You’re capable of add paperwork and add notes to your questionnaire, each of which I extremely advocate doing. Within the notes, I wrote a couple of sentences explaining my residing state of affairs (from the US, completely residing in Australia) and work state of affairs (a shit present… simply kidding! Extra like, a number of revenue streams and unable to slot in any present field). I uploaded my tax returns from final 12 months, my revenue and expense spreadsheets, and any tax kinds I obtained associated to my financial institution accounts and scholar loans.

Not too lengthy after, my assigned accountant despatched me an digital engagement letter – principally a contract for me to learn and signal, granting her permission to proceed with my tax return. The letter contains the whole quantity you’ll be charged for his or her providers, however you gained’t must pay till after they end their work. It took about two weeks for my tax return to be accomplished after signing the engagement letter. I wasn’t in a rush, as expats get an computerized two-month extension for submitting.

Now, everybody’s tax state of affairs is totally different, so this won’t be what your US expat taxes appear to be… however for me, Taxes For Expats helped me decide the next:

- I now pay tax to Australia and to not the US anymore, so I didn’t owe any taxes on this return.

- I might have been penalized for contributing to my US IRA account without having any taxable US revenue. I’m undecided how precisely this works, however my accountant took under consideration the dates of my current visits to the US and decided that if she delayed submitting my tax return till mid-August, I wouldn’t be penalized for the IRA contribution. So going ahead, earlier than I make any extra contributions to my IRA, I’ll verify in with my accountant to see if I can accomplish that with out penalty.

- I don’t must pay US self employment tax (though TurboTax advised me I did!), and I don’t must file a US state tax return. I’d been paying that self employment tax the previous couple years regardless of not owing any US taxes, so I’m extraordinarily glad that I didn’t make the identical mistake this 12 months!

In the event you’re a US citizen residing and dealing overseas, I can undoubtedly advocate Taxes For Expats for finding out your US expat taxes. They’re tremendous straightforward to work with regardless of the place you’re on the earth, very clear about what they do and the way a lot they cost for it, and would possibly even be capable to prevent some cash in your tax returns.

Going ahead, my plan for tackling my twice-annual tax returns as an American expat completely residing in Australia is to work with Taxes For Expats for my US tax return, and an area accountant in Sydney for my Australian tax return.

If you wish to give Taxes For Expats a attempt, sign up using this link and also you’ll get $25 off your first tax return with them!