by Tom Konrad, Ph.D. CFA

The Baltic Dry Index (BDI) is a delivery and commerce index created by the London-based Baltic Change. It measures adjustments in the price of transporting numerous uncooked supplies, comparable to coal and metal.

Because the BDI is a measure of the earnings which companies that personal dry bulk cargo ships can earn, adjustments within the BDI are likely to drive adjustments within the inventory costs of such corporations.

Inventory Worth Correlation

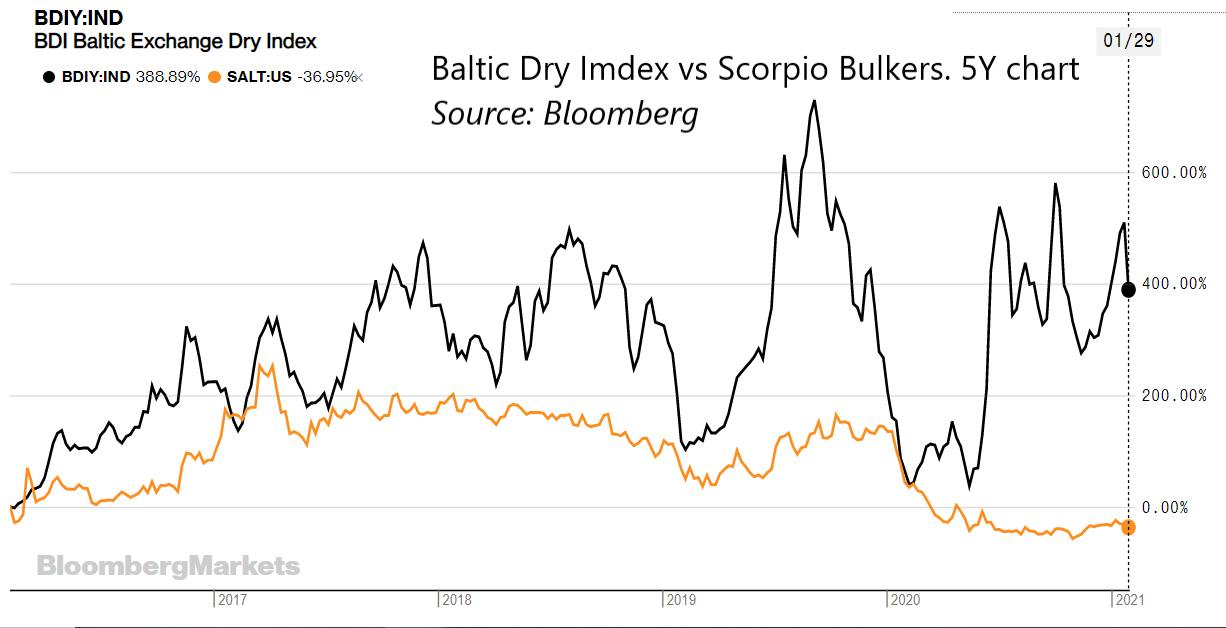

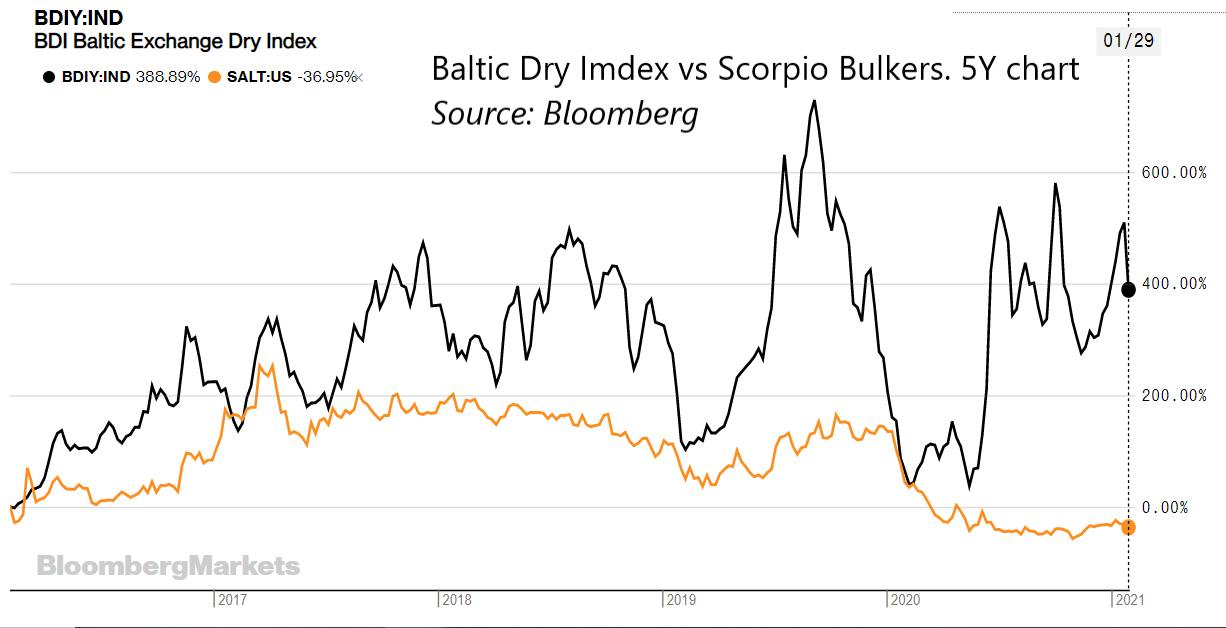

Till not too long ago, one such firm was Scorpio Bulkers (SALT), one among my Ten Clear Vitality Shares for 2021 picks. The chart beneath exhibits the final 5 years, with adjustments within the BDI resulting in adjustments in SALT’s inventory worth.

There’s additionally one notable exception to those correlated strikes in June 2020, when the corporate recapitalized in a secondary providing.

On August third, SALT introduced its new technique of investing within the subsequent era of offshore wind turbine funding vessels and promoting its fleet of dry bulk carriers.

As SALT’s dry bulk fleet is bought, the corporate’s future earnings change into more and more unbiased of BDI. If the market had been appearing rationally, the correlation of the inventory with BDI must also fall over time.

We’re not seeing that.

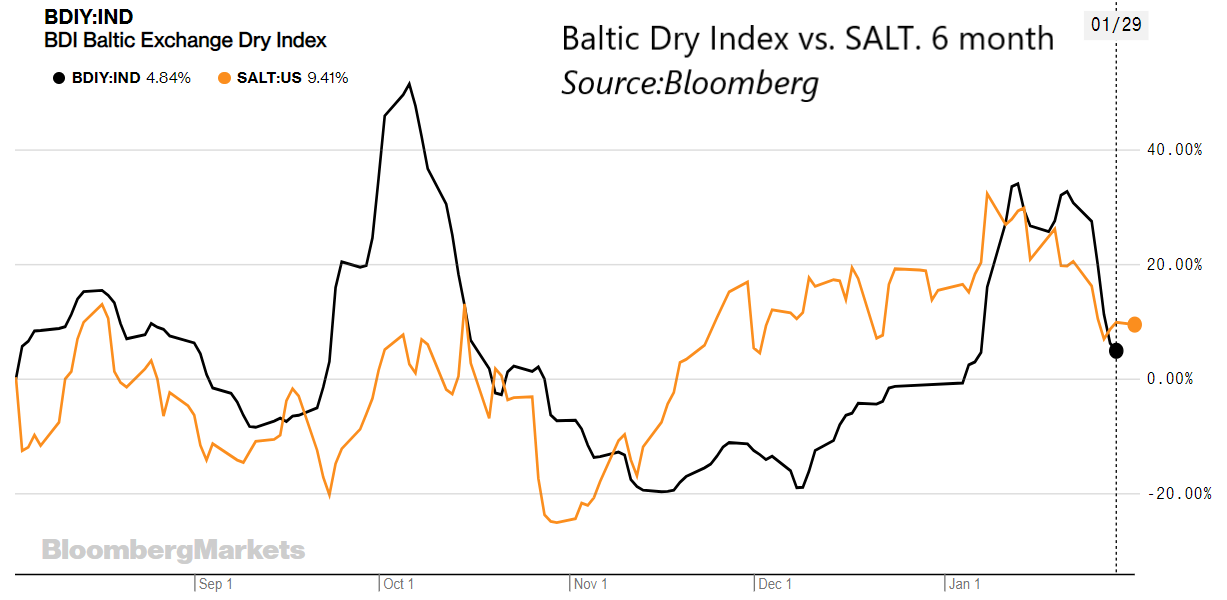

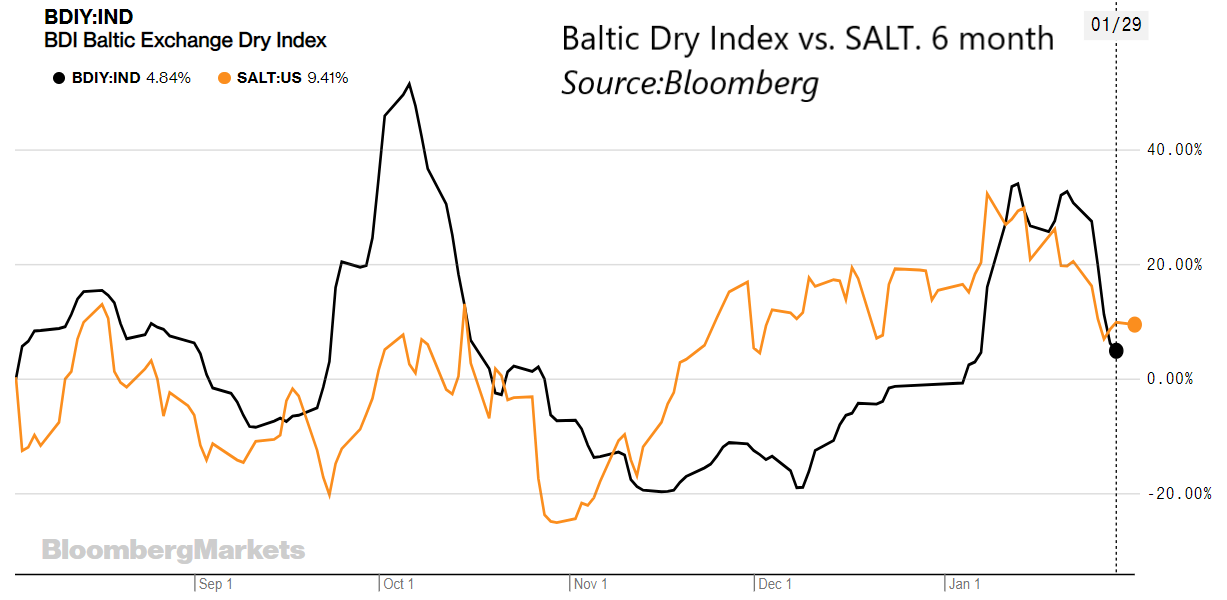

In October, 50-ish % strikes within the BDI led to 25-ish % strikes in SALT. In January, we noticed two 30-ish % strikes within the BDI, and the corresponding strikes in SALT had been round 10 % to twenty %.

Vessel Gross sales

In each circumstances, the inventory strikes had been roughly half the dimensions of adjustments within the BDI. Between the beginning of October and the top of January, SALT introduced the sale of twenty-two Vessels: 7 in October, 3 in November, 6 in December, and 6 in January. The corporate has bought roughly two-thirds of its fleet for the reason that new technique was introduced on August third, however the inventory continues to be following the index..

Why is BDI Nonetheless Driving the Inventory?

The continued correlation between SALT and BDI is probably going as a consequence of quantitative hedge funds utilizing programmatic buying and selling to make the most of correlations between BDI and all dry bulk shippers. A few of these packages (which can rely totally on machine studying) haven’t but been up to date (or up to date themselves) to replicate SALT’s declining dependence on dry bulk delivery for its future earnings.

Timing

When a inventory falls for causes that should not have to do with its fundamentals, I name it a shopping for alternative.

BDI and SALT have each fell in late January. Sufficient mentioned.

DISCLOSURE: Lengthy SALT.

DISCLAIMER: Previous efficiency isn’t a assure or a dependable indicator of future outcomes. This text accommodates the present opinions of the creator and such opinions are topic to alter with out discover. This text has been distributed for informational functions solely. Forecasts, estimates, and sure data contained herein shouldn’t be thought of as funding recommendation or a suggestion of any explicit safety, technique or funding product. Data contained herein has been obtained from sources believed to be dependable, however not assured.

The Baltic Dry Index (BDI) is a delivery and commerce index created by the London-based Baltic Change. It measures adjustments in the price of transporting numerous uncooked supplies, comparable to coal and metal.

Because the BDI is a measure of the earnings which companies that personal dry bulk cargo ships can earn, adjustments within the BDI are likely to drive adjustments within the inventory costs of such corporations.

Inventory Worth Correlation

Till not too long ago, one such firm was Scorpio Bulkers (SALT), one among my Ten Clear Vitality Shares for 2021 picks. The chart beneath exhibits the final 5 years, with adjustments within the BDI resulting in adjustments in SALT’s inventory worth.

There’s additionally one notable exception to those correlated strikes in June 2020, when the corporate recapitalized in a secondary providing.

On August third, SALT introduced its new technique of investing within the subsequent era of offshore wind turbine funding vessels and promoting its fleet of dry bulk carriers.

As SALT’s dry bulk fleet is bought, the corporate’s future earnings change into more and more unbiased of BDI. If the market had been appearing rationally, the correlation of the inventory with BDI must also fall over time.

We’re not seeing that.

In October, 50-ish % strikes within the BDI led to 25-ish % strikes in SALT. In January, we noticed two 30-ish % strikes within the BDI, and the corresponding strikes in SALT had been round 10 % to twenty %.

Vessel Gross sales

In each circumstances, the inventory strikes had been roughly half the dimensions of adjustments within the BDI. Between the beginning of October and the top of January, SALT introduced the sale of twenty-two Vessels: 7 in October, 3 in November, 6 in December, and 6 in January. The corporate has bought roughly two-thirds of its fleet for the reason that new technique was introduced on August third, however the inventory continues to be following the index..

Why is BDI Nonetheless Driving the Inventory?

The continued correlation between SALT and BDI is probably going as a consequence of quantitative hedge funds utilizing programmatic buying and selling to make the most of correlations between BDI and all dry bulk shippers. A few of these packages (which can rely totally on machine studying) haven’t but been up to date (or up to date themselves) to replicate SALT’s declining dependence on dry bulk delivery for its future earnings.

Timing

When a inventory falls for causes that should not have to do with its fundamentals, I name it a shopping for alternative.

BDI and SALT have each fell in late January. Sufficient mentioned.

DISCLOSURE: Lengthy SALT.

DISCLAIMER: Previous efficiency isn’t a assure or a dependable indicator of future outcomes. This text accommodates the present opinions of the creator and such opinions are topic to alter with out discover. This text has been distributed for informational functions solely. Forecasts, estimates, and sure data contained herein shouldn’t be thought of as funding recommendation or a suggestion of any explicit safety, technique or funding product. Data contained herein has been obtained from sources believed to be dependable, however not assured.